Welcome to WordPress. This is your first post. Edit or delete it, then start writing!

On February 24, 2014, Vince McMahon, chairman, and CEO of World Wrestling Entertainment, Inc., (WWE), launched WWE Network, a “Netflix-style” streaming service. To access the content the subscribers of the service paid directly WWE, thus, bypassing a cable or satellite provider. Taking advantage of the growing popularity of services like HDO GO, WWE Network became available on most digital platforms, including WWE.com, and as an app for Android, Apple, and more.

Vince McMahon and his operating team made bold changes to reinvent the 20-year-old entertainment company to follow the change in fans’ habits. Thus, WWE shares skyrocketed more than 402% following the transformation and the company was named the “12th best-performing medium-to-large US stock in 2017” by Forbes and had the steady “Buy” rating since February 2018 based on the opinion of polled investment analysts.

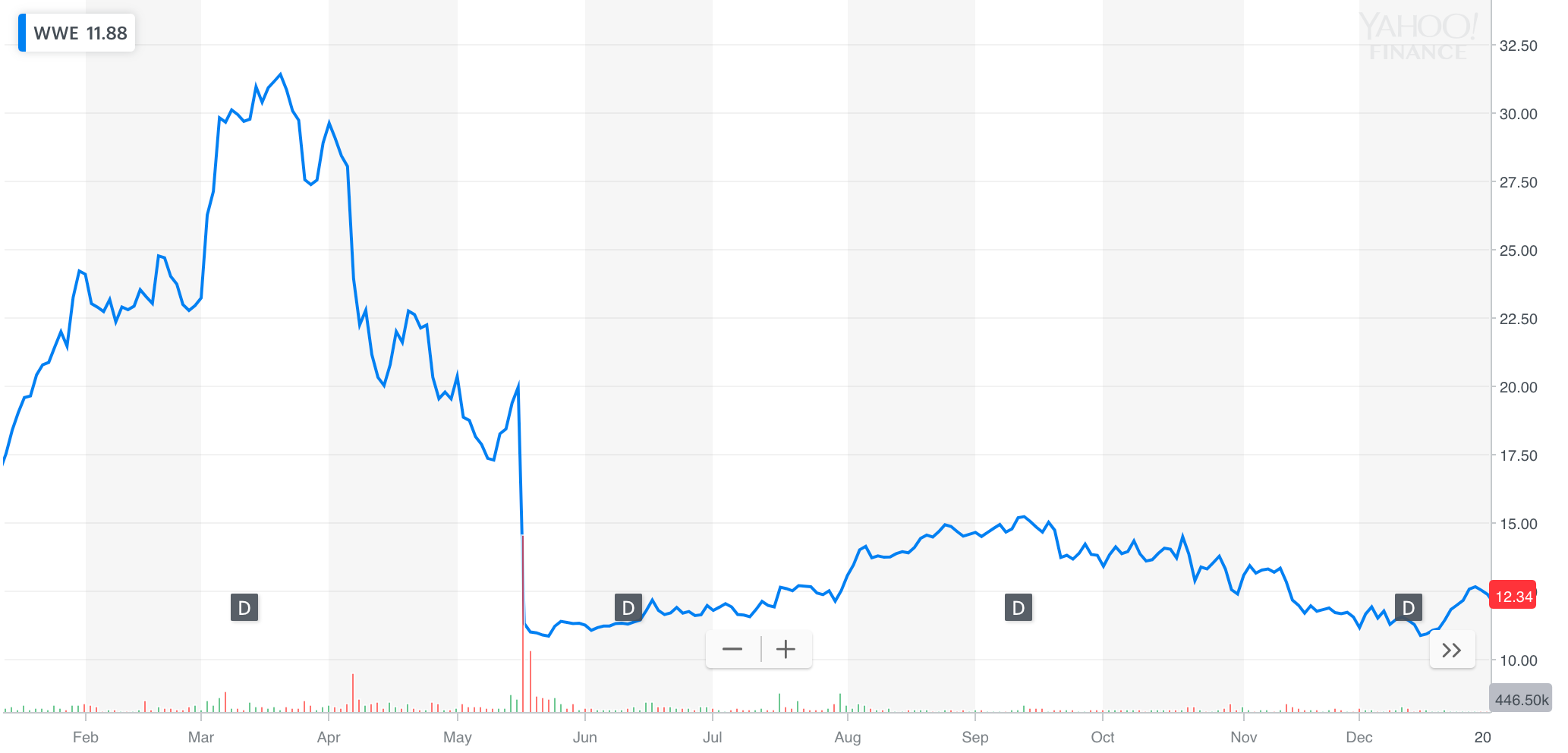

The chart below represents the first market reaction for the changes made by World Wrestling Entertainment (WWE):

In 2014, WWE transformed its core business by launching WWE Network, where customers paid a monthly $9.99 subscription for the streaming service.

Early after the launch, WWE Network topped 600.000 paid subscribers and was far exceeding investors’ expectations, replacing Television as the WWE top revenue source. While WWE had been transitioning to the subscription model, it got a moment to renegotiate key television distribution agreements that increased rights fees by approximately $100 million from 2014 to 2018.The Rise of Data-Driven Investing – Data Driven InvestorWhen JCPenney reported its financial results for 2Q 2015, it came as quite a shock to the market. The US retail giant…www.datadriveninvestor.com

Before that bright moment, the company was dead money for 17 years. WWE became public in 1999 and its stock stagnated through 2013. 41% of its revenue came from TV contracts and licensing. Big cable companies acted as gatekeepers to their fans and limited the company’s ability to renegotiate the contracts.

Vince McMahon followed the technology trend of “Netflix-style” streaming services for WWE business transformation. The strategy aimed at avoiding cable companies and connecting directly with fans.

The company researched that WWE’s fans were highly intended for watching digital video content. They watched 5 times the amount of digital content compared to average and were inclined to a streaming service subscription.

WWE Network was in an attractive position having a large fanbase who was paying for the WWE content to cable or satellite companies and WWE Network was a very cost-effective alternative for them.

The fans were offered to pay $9.99 monthly subscription fee instead of paying $45 price for a single Pay per view option or a monthly subscription fee for cable TV.

Almost immediately after the launch, the initial demand overwhelmed their systems and the website crashed. The WWE technology team was not ready for such a traffic influx.

The 2014 Annual public report announced that WWE Network had approximately 1,490,000 gross additions to its subscriber base. For a service less than eleven months old it was a respectable number.

Though, costly user acquisition and churn were at the negative side of the transformation. By the end of 2014, 674,000 subscribers churned out and approximately 567,000 subscribers remained. This gave $69.5 million in new subscription revenue in 2014. The numbers were far below investors’ expectations.

The Transformation Continues

Significant accomplishments in term of content delivery allowed WWE to bypass cable companies and to get direct access to its fan base. Following WWE’s achievements, other major entertainment companies like CBS, HBO, and Nickelodeon announced plans to bring their content directly to consumers. That was a sign for WWE that they were moving in the right direction.

But the new approach was proving to be an expensive venture which needed a constant inflow of new fans. Investors were interested in the growth of the number of new subscribers and their expectations were tremendous even for the brand like WWE.

To meet those expectations, WWE formulated the strategic plan to grow WWE Network that would focus on five points:

- Geographical expansion

- Expanding distribution platforms

- Creating new content

- Adding new features

- Aggressive user acquisition and marketing programs.

In mid-2014, the company announced the international expansion of WWE Network. It went live in over “170 countries and 35 languages around the world”. Revenue generated internationally reached 26% of total net revenue in 2015.

The next move was even more venturesome — free trials. Services like Netflix and Hulu offered the right to cancel subscription any time. The WWE Network original subscription offer had a six-month commitment, but the fans didn’t like it which restrained acquisition of new customers. So WWE ultimately moved to one-month free trial offer, that became a great acquisition tool.

WWE Network’s number of subscribers was positively affected by the changes and increased by 32%, in 2015 compared to 2014, as seen on the graph below. But, the number of Net Additions decreased by half from 816,000 to 401,000, driven primarily by the churn in paid subscribers. The decline of Net Additions continued during the next 2 years and became the main threat to the company.

Data-driven acquisition strategy

WWE Network had to acquire new subscribers steadily to compensate for the churn of subscribers and to achieve the needed growth rate. Financial outlook, liquidity, business, and operating results became directly affected by the company’s ability to acquire new subscribers in sufficient numbers.

Euphemistically termed “churn,” the six-figure decline in subscriptions proved to be the ongoing issue for WWE every year. In 2015 the churn rate reached 80% (calculated based on the 2016 Annual report) and grew continually to 90% and even 96% in 2016 and 2017 respectively. Churn escalated in the periods following WrestleMania as the biggest event of the year. Greater sales during high seasons resulted in significant churn during off-peak seasons.

And again, similarly to Netflix, WWE started using more data to customize marketing campaigns in order to retain paying subscribers and to decline churn. Data collection and usage became a part of the fundamental transformation of WWE.

The company generated up to 10 million user profiles and hired 40 data scientists to substantially improve the company’s ability to leverage data. For instance, WWE developed a content recommendation system based on subscribers viewing data.

By looking at variables such as network consumption, ticket purchases, and website activity, WWE had refined marketing efforts, production strategy, and so on to maximize ticket sales and improve fans’ experience. WWE relied on data to make decisions about investments and development. Even content creation was supervised by data analysis which was seen as an innovative way to success.

The 2017 year’s results show that WWE’s transformation succeeded. Direct to consumer transformation strengthed the company’s market position.

WWE revenue grew by 61% from 2013 to 2018. The share of Television contracts balanced with own media incomings. The modest success of WWE Network won a moment for the company to renegotiate key television distribution agreements that increased rights fees by approximately $100 million from 2014 to 2018. The company’s stock prices gained significantly in 2018.

Significant changes need time, resources and mental health. It is very important, to be honest with yourself evaluating the ability to act in a bold way. The more money the existing business makes, the harder it is to innovate.

But, innovations are inevitable only because staying stable is threatened by disruptions. Thus, the real challenge is to persuade to move from the existing stagnant business model with all the profit to another where so many innovations are met.

On the way to transformation, the main point is your audience and the audience discovery has to be the starting point. To deliver products that customers want, be ready to do it on their terms.

“That’s what makes people successful: the willingness and ability to navigate the scary hallway.” — George Barrios, WWE’s chief strategy and financial officer